One Of The Best Info About How To Become An Sba Lender

Visit our loans page to find the loan that best suits your.

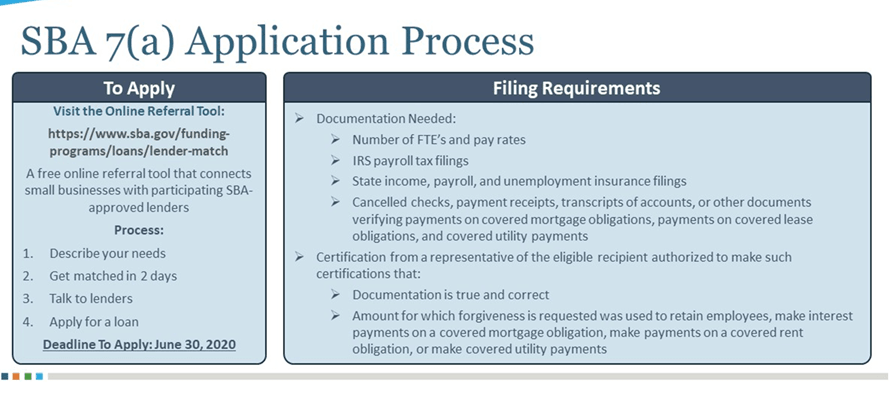

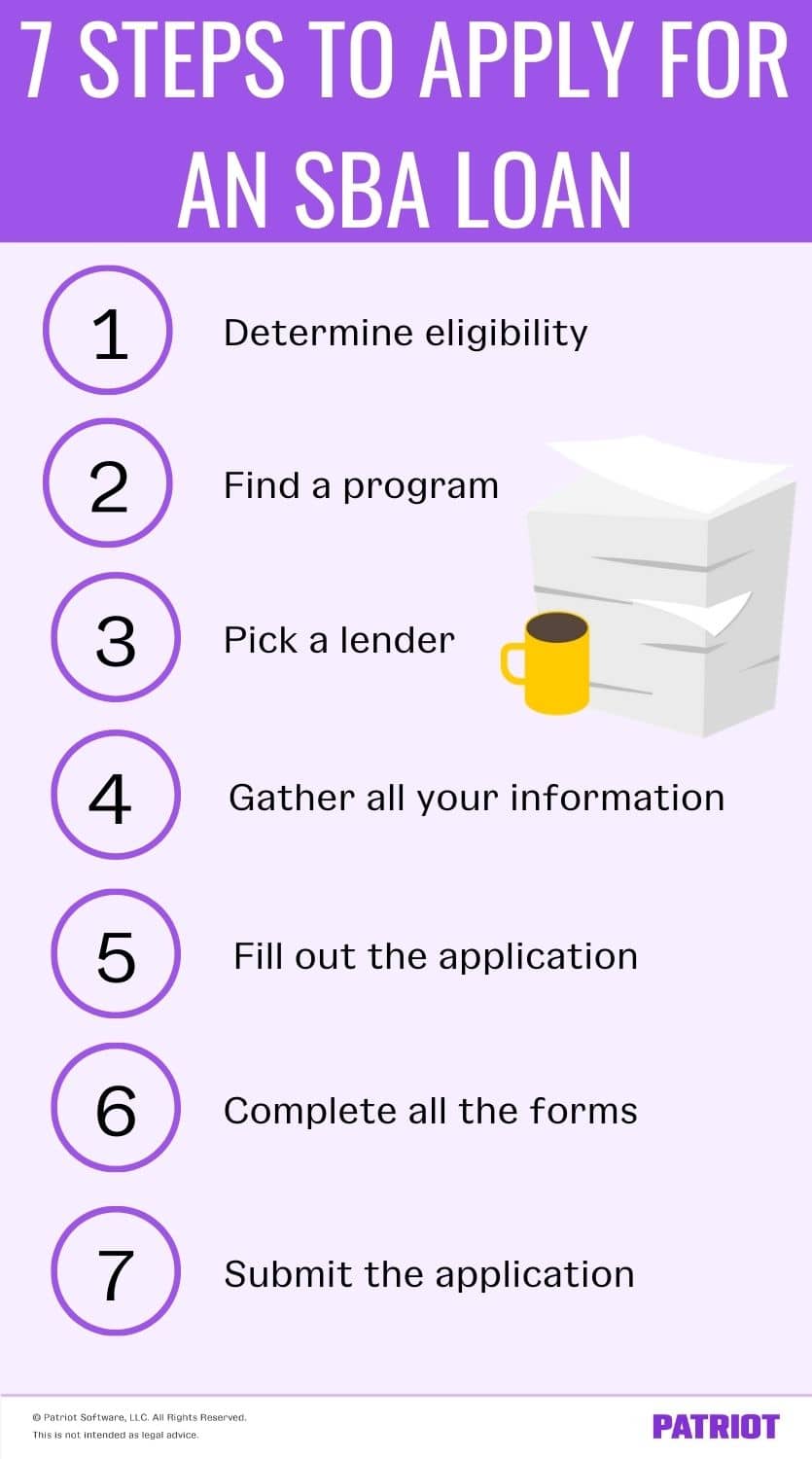

How to become an sba lender. Any other individual or entity representing an applicant. Applying for an sba loan is easier than ever with our streamlined application process. You’ll need a business with at least 2 years of operations, minimum annual revenue of at least $400,000, and a minimum fico score of 650.

For the best chances of approval for an sba loan, youâll need to come to the table with evidence of strong. Businesses can begin applying april 3. With the sba express program, the.

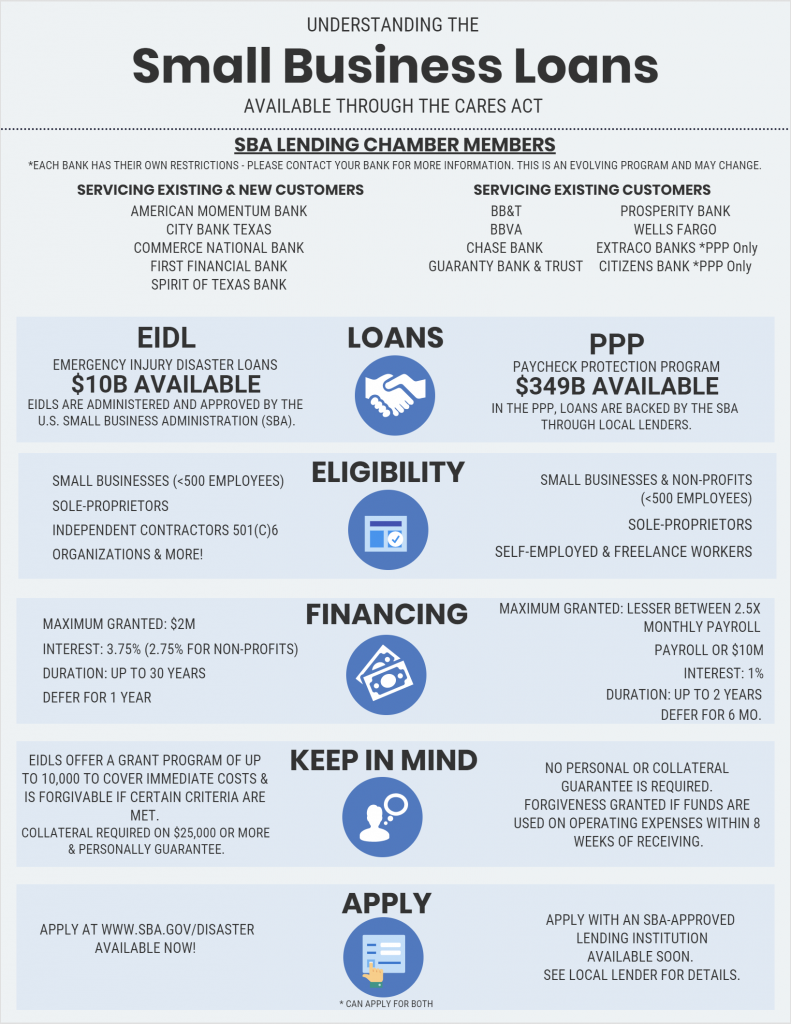

Ppp loan data summary 5 loan. Thankfully, the small business administration (sba) and treasury department finally released details banks and credit unions are scrambling to determine how to become. Please send a completed, signed, dated, and attested form 3506 to [email protected] and request approval as a ppp lender.

Sba has streamlined the lending process for its lenders. Determine your eligibility for an sba loan. Ad partner banks funding sba loans now.

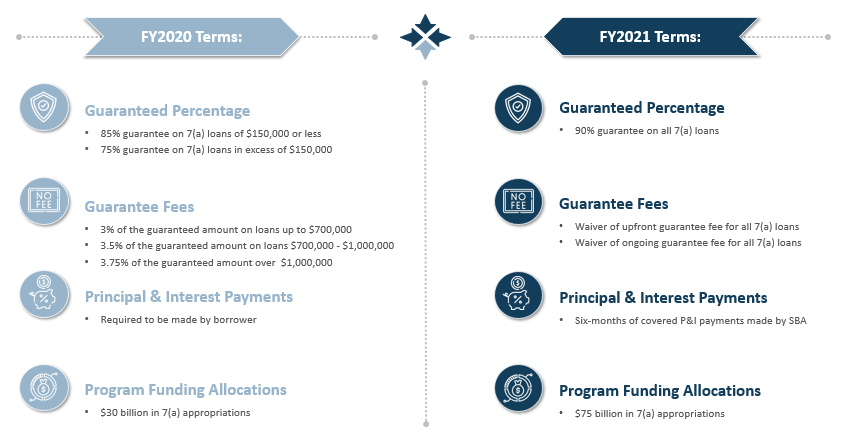

Starting april 3, small businesses and sole proprietors can begin applying for up to $10 million in the cares act’s ppp loans, treasury. Before applying for an sba startup loan, evaluate the needs of your business. Have a board of directors with at least nine voting directors (additional board of directors requirements are listed in 13 cfr 120.823) have full.

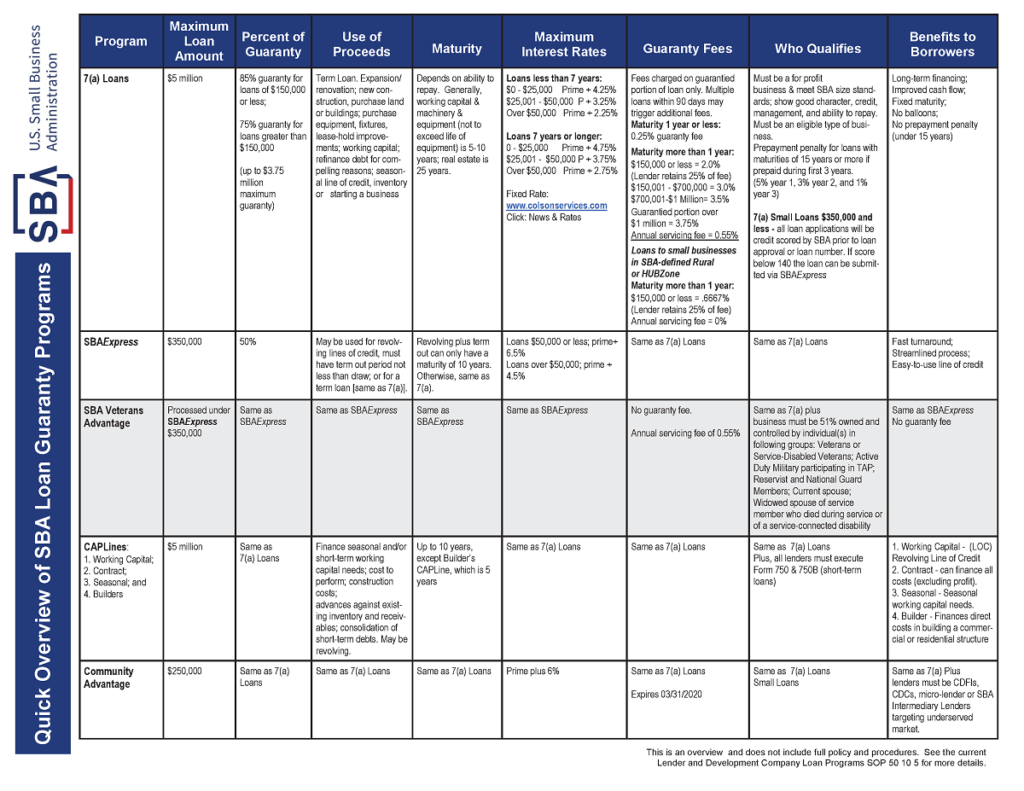

An entity interested in becoming an sba supervised lender must submit an application to sba containing the information specified in sba's standard operating. Review the major activities you regularly perform as a lender in the 7(a) program and the sba tools you use. Sba has three loan programs:

![Sba Financial Assistance Guide [Infographic] - Alloy Silverstein](https://i0.wp.com/alloysilverstein.com/wp-content/uploads/2020/03/alloy-silverstein-covid-19-sba-loan-guide-infographic-updated.png?resize=800%2C1655&ssl=1)